Non Profit Accounting Solutions Explained in Under 3 Minutes: Grant Tracking, Compliance, and Transparency Made Simple

- Gina Cantin

- Dec 9, 2025

- 3 min read

Running a nonprofit comes with unique financial challenges that for-profit businesses never face. Between tracking restricted donations, managing grant requirements, and maintaining transparency for donors and regulators, nonprofit accounting can feel overwhelming. But here's the thing: with the right approach and tools, managing your organization's finances doesn't have to be complicated.

Why Nonprofit Accounting Is Different (And Why That Matters)

Let's start with the basics. Nonprofit accounting isn't just regular accounting with a different label. It's built around something called fund accounting, which is essentially a way to track different pots of money based on where they came from and how they can be used.

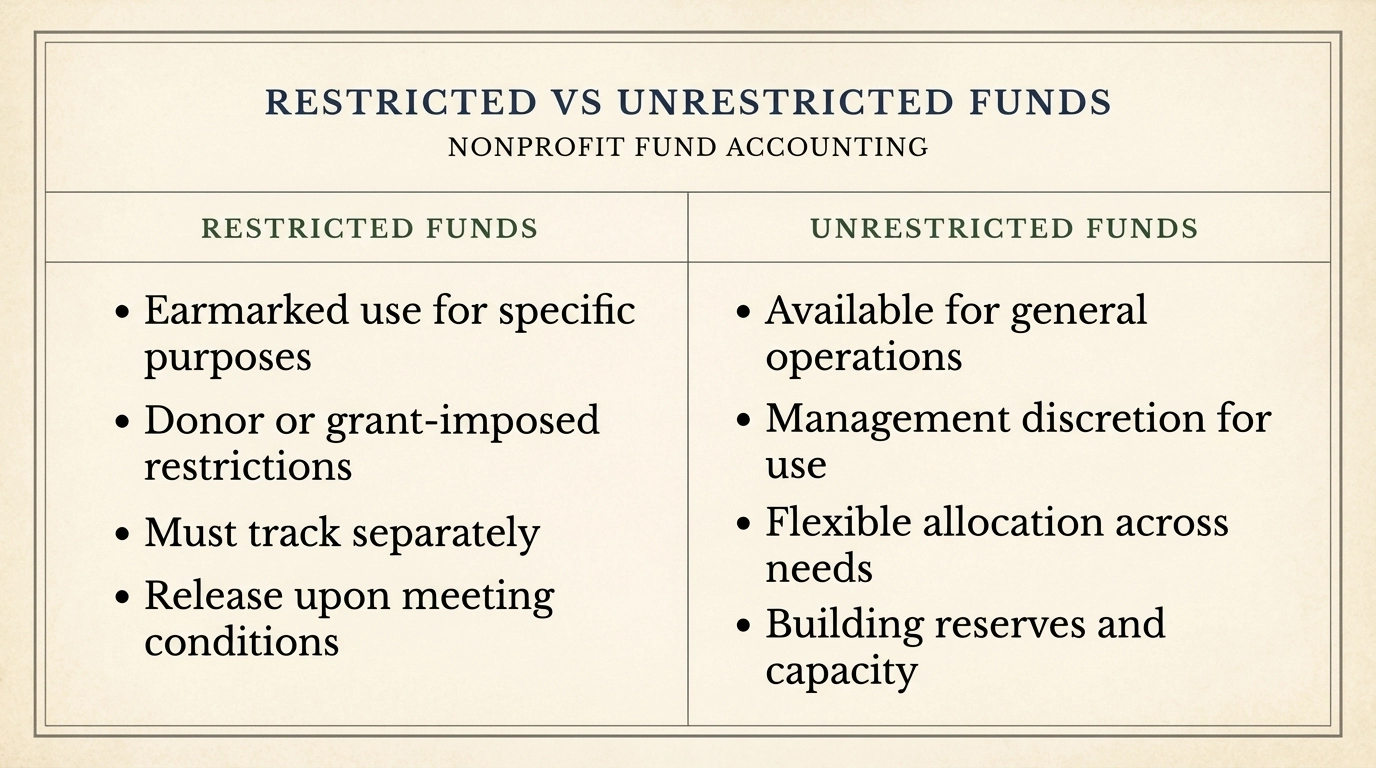

Think of it this way: when someone donates $5,000 specifically for your youth programs, you can't accidentally spend that money on office supplies. Fund accounting helps you track restricted funds (money with strings attached) separately from unrestricted funds (money you can use however you need). This separation isn't just good practice: it's often legally required.

Grant Tracking Made Simple

Grant management is where many nonprofits get into trouble. You've probably been there: frantically trying to figure out how much grant money you've spent, what it was spent on, and whether you're staying within budget. Sound familiar?

Modern nonprofit accounting solutions automate much of this headache. The best systems will:

Automatically categorize expenses by grant

Track spending against each grant's budget in real-time

Generate reports that match exactly what funders want to see

Alert you when you're approaching spending limits

Staying Compliant Without the Stress

Compliance isn't just about following rules: it's about protecting your nonprofit's reputation and funding. Different organizations face different compliance requirements:

GAAP Compliance: Generally Accepted Accounting Principles apply to most nonprofits and govern how you report finances.

FASB Standards: The Financial Accounting Standards Board sets specific rules for nonprofit financial reporting.

Grant-Specific Requirements: Each funder may have unique reporting and spending requirements.

State Regulations: Your state likely has specific nonprofit accounting requirements.

The key is having systems that make compliance automatic rather than something you scramble to achieve at reporting time. Cloud-based nonprofit accounting solutions can generate GAAP-compliant reports with just a few clicks, saving hours of manual work.

Building Trust Through Transparency

Donors want to know their money is making a difference. Board members need clear financial pictures to make strategic decisions. Regulators require detailed reporting.

Transparency isn't optional: it's essential for nonprofit success.

Real-time financial reporting gives you the transparency stakeholders expect. Instead of waiting weeks for financial statements, cloud-based solutions provide immediate access to:

Current financial position

Program-specific spending

Grant utilization rates

Cash flow projections

This immediate access helps board members stay engaged between meetings and gives donors confidence in your stewardship.

Choosing the Right Solution

Not all accounting software works well for nonprofits. Here's what to look for:

True Fund Accounting: Make sure the software can handle restricted and unrestricted funds separately.

Grant Management: Look for built-in grant tracking and reporting features.

Donor Integration: The best solutions connect donor management with financial reporting.

Real-Time Reporting: Cloud-based access means stakeholders can review finances anytime.

Compliance Features: Automated GAAP-compliant reporting saves significant time.

Getting Professional Help

Even with great software, many nonprofits benefit from professional accounting services. The complexity of grant compliance, fund restrictions, and regulatory reporting often requires expertise that's hard to maintain in-house.

At GMC Consulting Group, LLC, we work with nonprofits to streamline their accounting processes while ensuring full compliance. Our advisory services help organizations choose the right systems and set up processes that grow with their mission.

Whether you're a small community organization or a large nonprofit managing multiple grants, having the right accounting foundation makes everything else easier. From grant applications to board reporting to donor stewardship, solid financial systems support every aspect of your work.

Ready to Simplify Your Nonprofit Accounting?

The right nonprofit accounting solutions don't just manage your money: they free you to focus on your mission. With automated grant tracking, simplified compliance, and real-time transparency, you can spend less time on paperwork and more time changing the world.

If you're ready to explore how professional accounting services can transform your nonprofit's financial management, we're here to help. Because when your accounting is simple, your mission can soar.

Comments